About

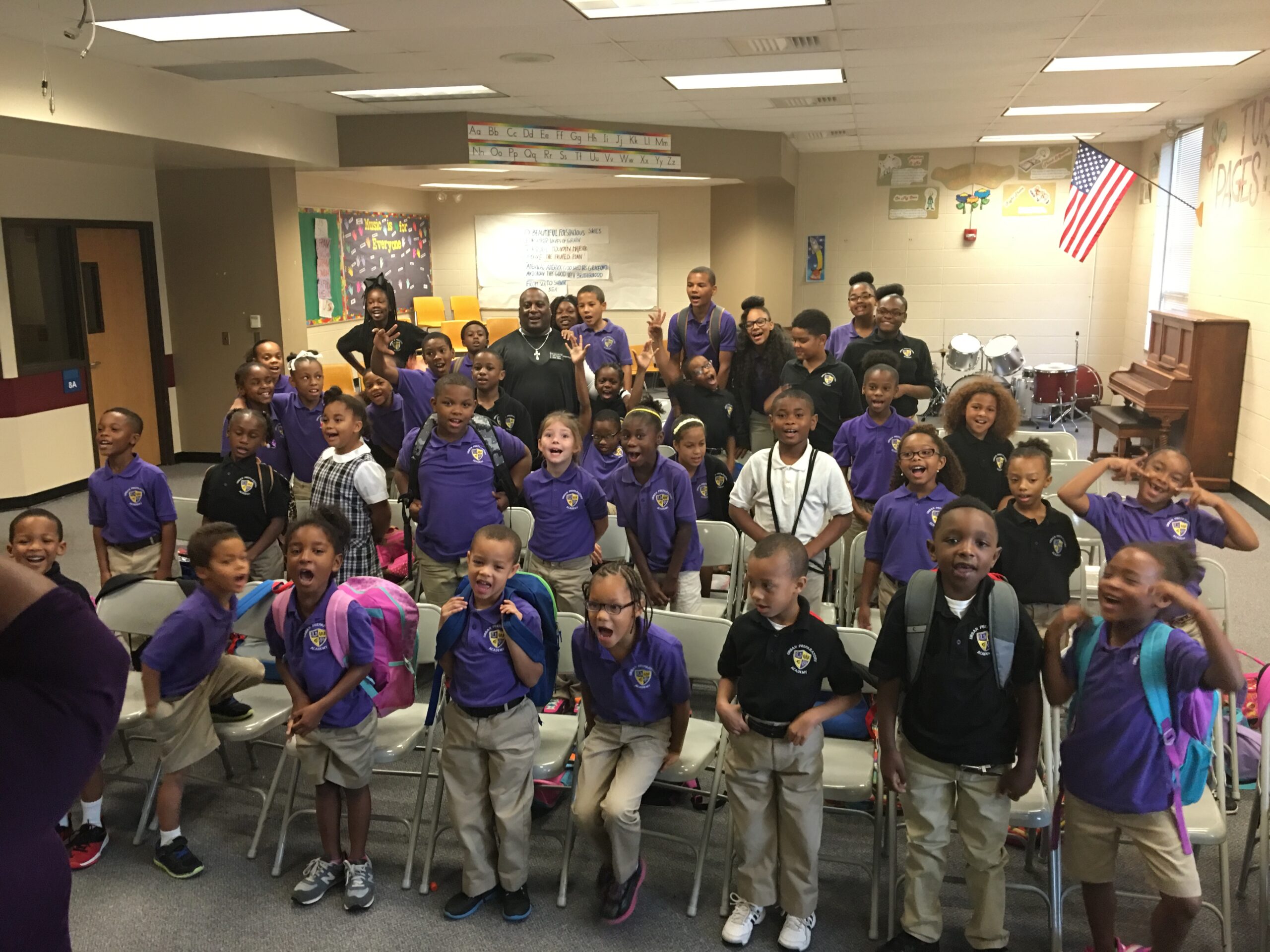

With a free financial literacy curriculum and teaching training program Rapunzl is helping to bridge the country’s economic divide by exposing students from underserved communities and empowering them to view the world as investors and succeed in financial services careers. With the world of finance and the high-returns of Wall Street seeming inaccessible and out of reach for most, co-founders Brian Curcio and Myles Gage met freshman year of high school and built Rapunzl to change this for students. Transitioning from the bank and financial investment industries, they built, broke, and rebuilt an innovative, hybrid financial literacy curriculum in 2018, which has inspired over 35,000 students, over 80% who identify as people of color. By showing students that they can thrive in financial services careers and providing them with the tools to build generational wealth, this cutting edge ed tech program transforms the way students perceive themselves in the world. They provide equitable access to real-world financial education materials for high school students from underserved communities and leverage a free, simulated investing app to offer affordable, relevant, and engaging financial literacy tools. Students engage in simulated stock portfolios and even stock trading competitions.

Their Story

Rapunzl’s goal is to make financial education more accessible and ensure that all children are prepared with the financial acumen necessary for the post-pandemic world by offering a scalable, high-quality digital curriculum able to reach families across the socioeconomic spectrum.

LEADER QUOTE

Financial literacy is essential because it really helps break the generational poverty cycle but also exposes students to careers in financial services…Staying financially literate is also important to having people be productive and engaged members of society.

1

Why they stand out

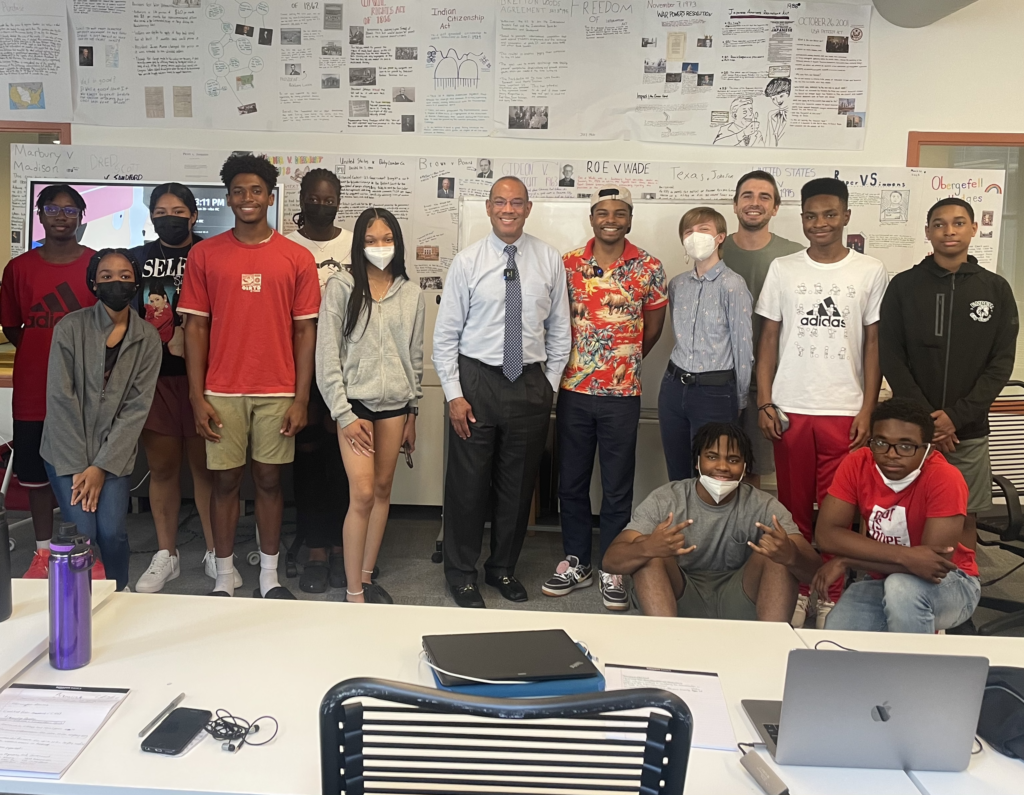

Carl Sandburg famously described America’s third largest city, Chicago, as one full of folks who are “shoveling, wrecking, planning, building, breaking, rebuilding.” Chicago-based founders of ed tech company Rapunzl are made of such stuff. They identified a problem in American education with real-world consequences: financial illiteracy. With Rapunzl, students gain invaluable financial intelligence for life by learning money while actively earning money. Ask the nation’s student loan borrowers who are in more than 1.7 trillion dollars of debt for more on that. Students need to know what money is and what to do with it—responsibly. The financial system is broken for ordinary investors because it fails to be inclusive, educational, and engaging for ordinary people.

2

How they STOP for education

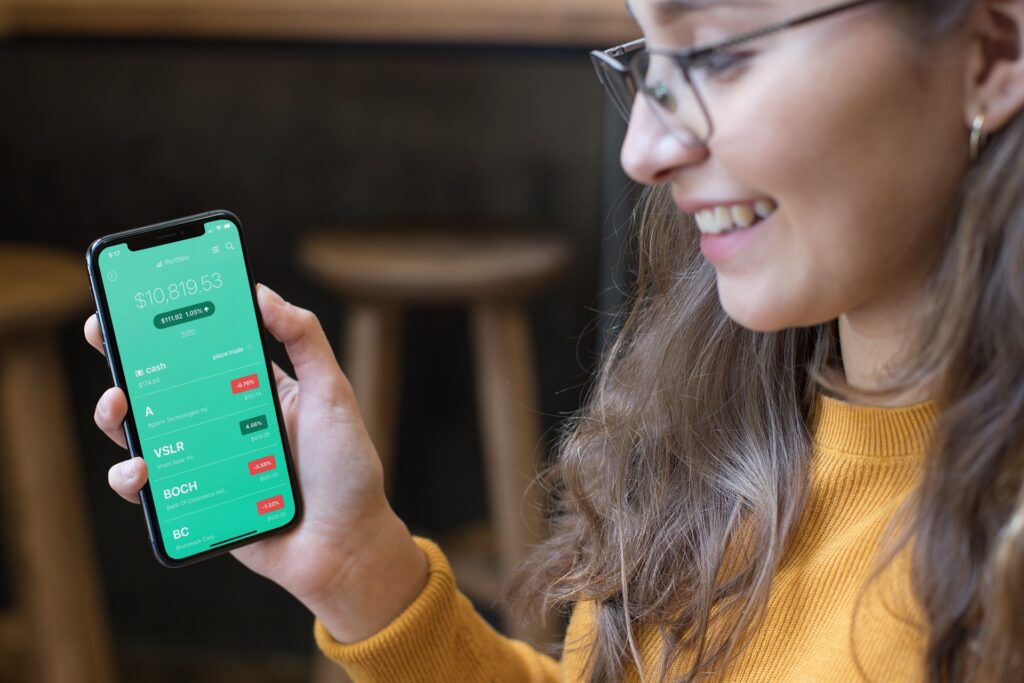

A transformational digital finance curriculum is designed for any skill-level and embedded into a mobile platform that promotes self-guided learning.

The company has distributed attracted investments and is on track to break even as their expansion plans become a reality. To date, with their competitions and corporate partners, they’ve awarded over $250,000 in scholarships and generate recurring revenues to fund further awards.

Its open source curriculum and app that can be modified by teachers to meet the needs of all learners is permissionless for everyone.

3

Winning their award

Rapunzl already serves 11,000 high school students nationally, but being a Yass Prize finalist and STOP Award winner is rocket-fuel to their plans to increase reach to 75,000 students and expand into grades six through eight. It would also increase capacity for more high schools nationwide with a specific focus on Florida, Arizona, and Texas where they already have a large number of schools using the platform.